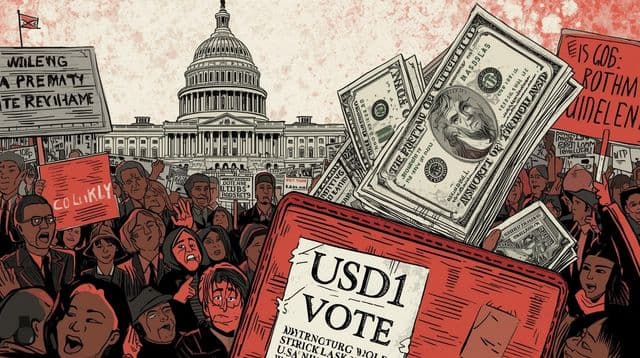

World Liberty Financial is facing community backlash after a governance vote approved a USD1 growth proposal despite limited participation from locked WLFI holders.

Onchain data shows the largest votes in favour came from wallets linked to the team or strategic partners, according to researcher DeFi^2.

The top nine wallets controlled about 59% of the total voting power, effectively determining the outcome of the proposal.

The single largest wallet accounted for 18.786% of voting power based on the governance snapshot.

“This is in contrast to the real voters lower in the screenshot, who have all been locked from accessing their WLFI tokens since TGE, and unable to vote on an unlock until the team allows it,”

DeFi^2 said.

Critics questioned why governance was used to expand USD1 rather than address token lockups affecting many investors.

“The real motivation becomes clear when you recall the fine print that WLFI holders are not entitled to ANY protocol revenue at all,”

DeFi^2 said.

A tokenholder who voted against the proposal warned it would further dilute investors without offering clear benefits.

The critic noted that WLFI’s treasury includes assets such as Bitcoin, Ether and Chainlink, yet holders receive no direct upside.