Transocean (NYSE:RIG), the Steinhausen, Switzerland-based offshore drilling titan, reported a complex set of fourth-quarter and full-year results, where strong operational cash flow and a multi-billion-dollar backlog were overshadowed by massive non-cash impairment charges.

The company posted a staggering full-year net loss of $2.915 billion, or $3.04 per diluted share, a sharp decline from the $512 million loss recorded in 2024.

The primary culprit was a $3.036 billion non-cash impairment charge related to the retirement of older vessels and a strategic shift in fleet valuation.

However, on an adjusted basis—stripping out these one-time items—Transocean delivered an adjusted net income of $37 million ($0.04 per share), marking a critical pivot toward underlying profitability.

Operationally, the firm demonstrated significant momentum.

Full-year contract drilling revenues rose 13% to $3.965 billion, supported by a fleet uptime performance of 96.5%.

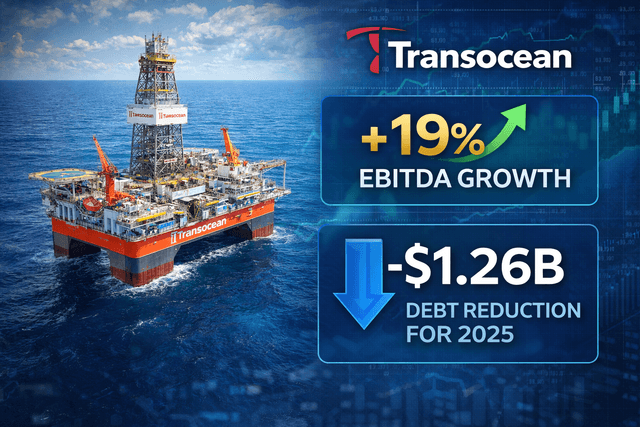

Adjusted EBITDA surged 19% to $1.37 billion, while the company successfully slashed its total debt by $1.26 billion, ending the year with a principal balance of $5.686 billion.