Johnson & Johnson (NYSE:JNJ) shares rose Wednesday after the healthcare giant capped a record-breaking 2025 with a major fourth-quarter earnings beat and issued a bold 2026 forecast that projects annual sales exceeding the $100 billion mark for the first time.

The New Brunswick-based company reported fourth-quarter revenue of $24.6 billion, a 9.1% increase year-over-year, driven by a surge in its Innovative Medicine (Oncology and Immunology) and MedTech divisions.

Adjusted earnings per share for the quarter reached $2.46, surpassing analyst estimates of $2.42.

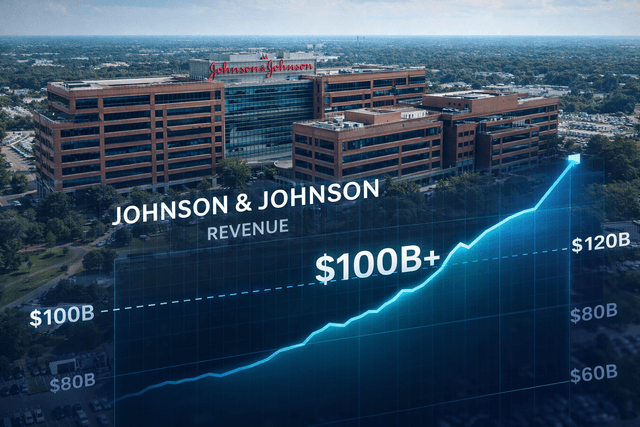

For the full year 2025, J&J generated $94.2 billion in total sales.

CEO Joaquin Duato described 2025 as a "catapult year," citing the successful absorption of Halda Therapeutics and the rapid scaling of the RYBREVANT lung cancer franchise as key drivers of the company’s "new era of accelerated growth."

Looking ahead to 2026, J&J issued guidance for reported sales of $100.5 billion at the midpoint, representing approximately 6.7% growth.

The company expects adjusted EPS to climb to $11.53, despite continued (but narrowing) headwinds from the Stelara biosimilar entries in Europe and the U.S.

A major catalyst for the coming year is the recently submitted OTTAVA™ Robotic Surgical System, which filed for FDA De Novo classification on January 7, 2026, positioning J&J to challenge the long-standing dominance of Intuitive Surgical in the soft-tissue robotics market.