IDEXX Laboratories (NASDAQ:IDXX) reported fourth-quarter earnings that surpassed analyst expectations, fueled by double-digit growth in its core companion animal business and significant margin expansion.

The pet healthcare leader saw its shares steady in early trading as it coupled the results with a robust 2026 outlook that projects continued earnings growth despite persistent declines in U.S. clinical visits.

For the quarter ended Dec. 31, 2025, IDEXX reported revenue of $1.09 billion, a 14% increase from a year earlier.

Earnings per diluted share rose 18% to $3.08, clearing the average analyst estimate of $2.93.

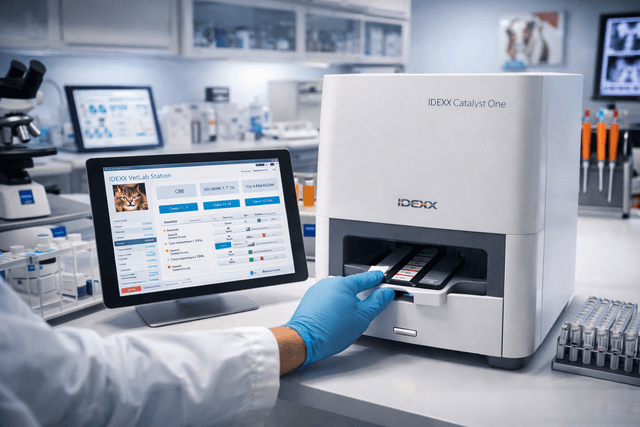

The performance was driven by the Companion Animal Group (CAG), which saw revenue climb 15% as reported, or 13% organically, as the company successfully converted a higher volume of diagnostic test frequency and premium instrument placements into recurring revenue.

For the full year 2025, the company delivered $4.30 billion in revenue and earnings per share of $13.08.

Results were buoyed by an operating margin expansion of 270 basis points on a reported basis, though about 180 basis points of that gain stemmed from a comparison to a prior-year litigation expense.