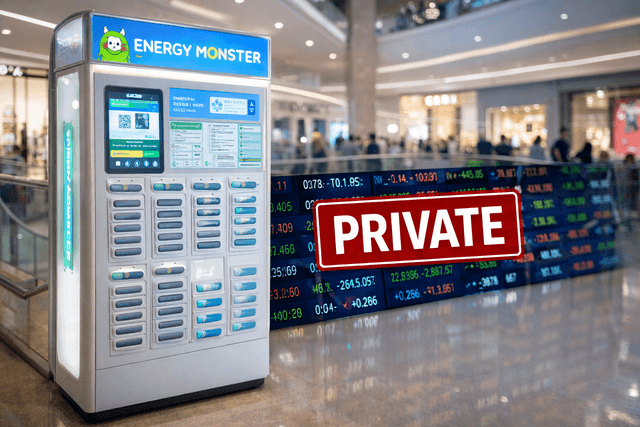

Smart Share Global (NASDAQ:EM), the Chinese mobile charging giant known as Energy Monster, is poised to go private after shareholders overwhelmingly approved a $327 million merger agreement at an extraordinary general meeting on Wednesday.

The deal, which sees the company become a wholly-owned subsidiary of Mobile Charging Investment Ltd. (MidCo), was approved by 92.8% of the votes cast.

Approximately 79% of the company's outstanding ordinary shares participated in the vote, representing 90.9% of the total voting power.

The successful vote marks the final major hurdle for a consortium led by Chairman and CEO Mars Guangyuan Cai and backed by Trustar Capital.

The privatization follows a contentious months-long battle.

Hillhouse Investment, the company’s second-largest shareholder, had labeled the $1.25-per-ADS offer as "premeditated theft," noting that the deal valued the company below its reported cash reserves of $415 million.

Hillhouse submitted a rival non-binding proposal of $1.77 per ADS in August, but the company’s special committee ultimately moved forward with the management-led bid, citing the existing consortium's 64% voting control and their refusal to support any alternative transaction.