Carvana (NYSE:CVNA), the Phoenix-based pioneer of the car-vending machine, reported fourth-quarter results that pulverized Wall Street expectations, fueled by a 43% surge in retail units sold and a massive expansion in profit margins.

The e-commerce platform posted fourth-quarter net income of $951 million, or $4.22 per diluted share—nearly quadruple the $1.13 per share anticipated by analysts surveyed by Zacks Investment Research.

Revenue for the period climbed 58% to $5.6 billion, easily clearing the $5.27 billion consensus.

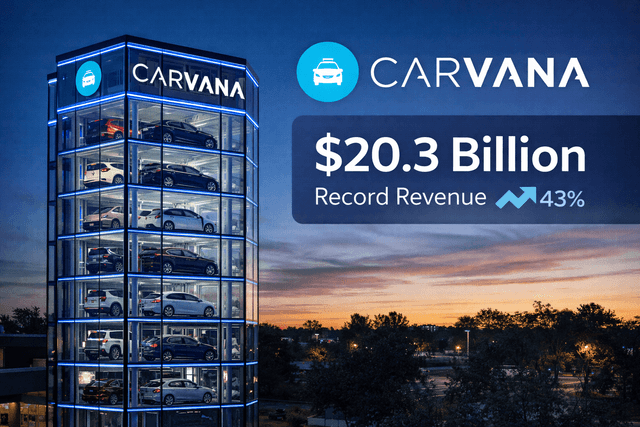

The stellar quarter brought full-year 2025 revenue to a record $20.3 billion, a 49% increase year-over-year.

Carvana's net income for the year reached $1.9 billion, a more than $1 billion increase from 2024, while adjusted EBITDA hit $2.2 billion.

Looking ahead to 2026, the company expects "significant growth" in both retail units sold and adjusted EBITDA.

Management also reaffirmed its long-term "management objective" of selling 3 million retail units annually at a 13.5% adjusted EBITDA margin by 2030–2035.

For the first quarter of 2026, Carvana projects a sequential increase in retail units sold as it leverages its 34 nationwide reconditioning centers to capture a larger slice of the used car market.