-640x360.png&w=1200&q=75)

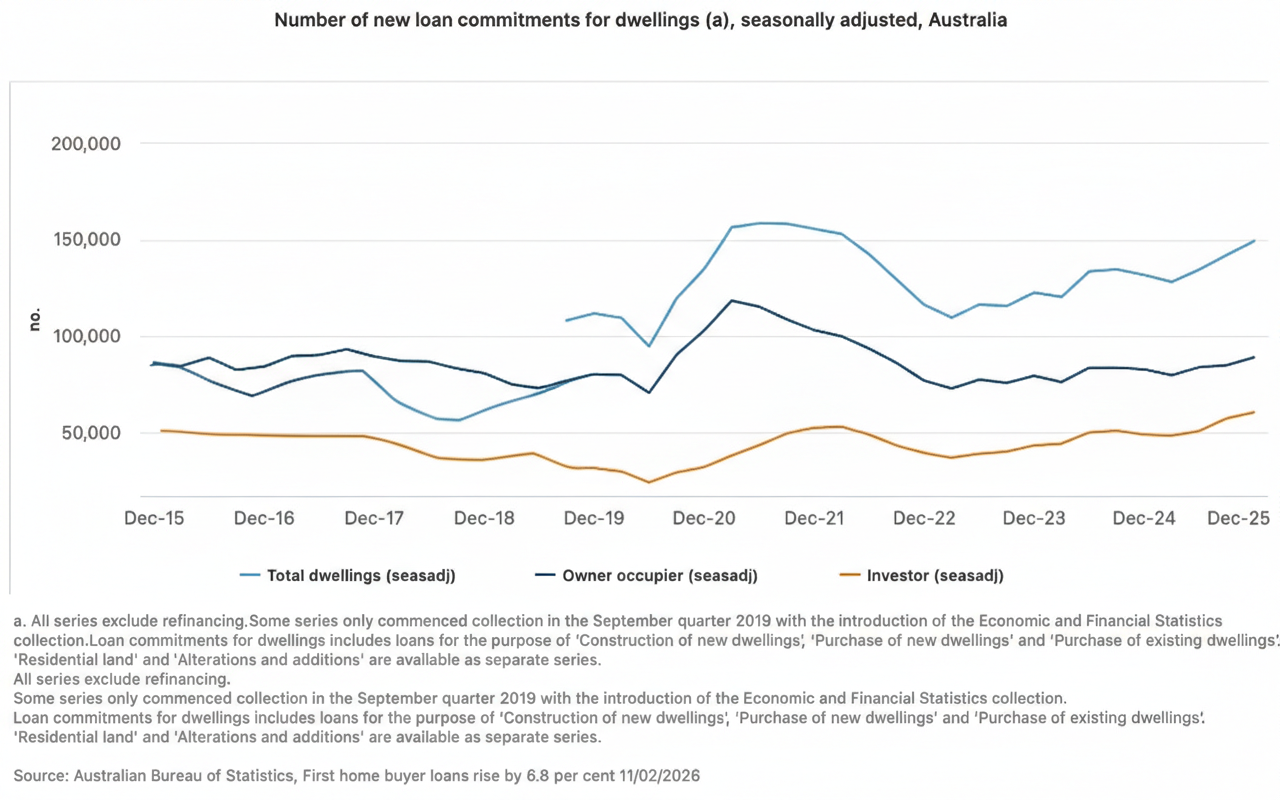

Australia's property market saw a rise in activity during the final months of 2025, fueled by a 6.8% jump in first home buyer loans.

According to the latest Australian Bureau of Statistics data for the December 2025 quarter, 31,783 new loans were issued to first-time buyers—the sharpest quarterly increase since 2023.

Dr. Mish Tan, ABS head of finance statistics, noted that growth was robust across the board. While first-time buyers led the charge, investor loans climbed 5.5% to reach a record 60,445 approvals, totaling a staggering $43 billion in value.

Owner-occupiers also saw a 3.6% uptick. "We are seeing strong growth across all borrower types," Dr. Tan said, attributing the first home buyer momentum to expanded federal support, including the 5% deposit scheme and the new help to buy scheme.

Geographically, New South Wales and Western Australia spearheaded the movement with increases of 10.9% and 9.8% respectively.

However, the dream of home ownership comes with a rising price tag; the average first home buyer loan hit a record $607,624, an 8.5% quarterly increase.

Investors also faced higher entry costs, with their average loan size climbing to $716,711.

While most of the nation trended upward, Tasmania saw a slight 1.7% dip in first-time buyer activity, even as its investment sector skyrocketed by 28.2%.