The Education Department confirmed it has no plans to restore a key student loan forgiveness tracking tool.

The decision was disclosed quietly in a footnote within a December court filing.

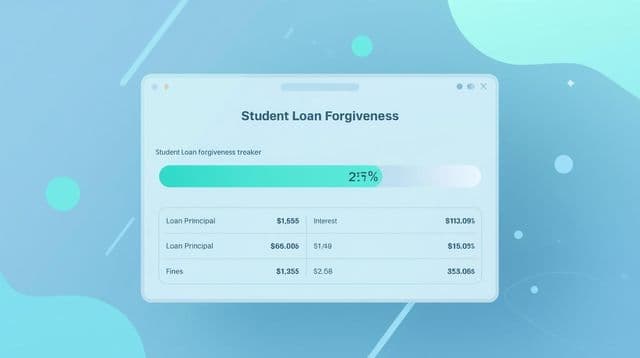

The tracker had allowed borrowers to monitor progress toward income driven repayment forgiveness.

Officials removed the feature earlier in 2025 following legal challenges tied to the SAVE plan.

The move contradicts earlier assurances reportedly given to Democratic lawmakers.

Senator Elizabeth Warren said Education Secretary Linda McMahon promised the tracker would return.

Secretary McMahon stated that she intends to soon restore the income driven repayment payment count tracker.

Elizabeth Warren said.

The tracker originally launched under the Biden Harris administration in early 2025.

It showed credited months remaining payments and eligibility across multiple IDR plans.

Borrowers used the tool to plan finances and potential tax liabilities from loan discharge.

The department removed the tracker in April after court rulings limited qualifying deferments.