Reserve Bank of Australia’s Monetary Policy Board announced a 25-basis point increase in the cash rate target, bringing it to 3.85%.

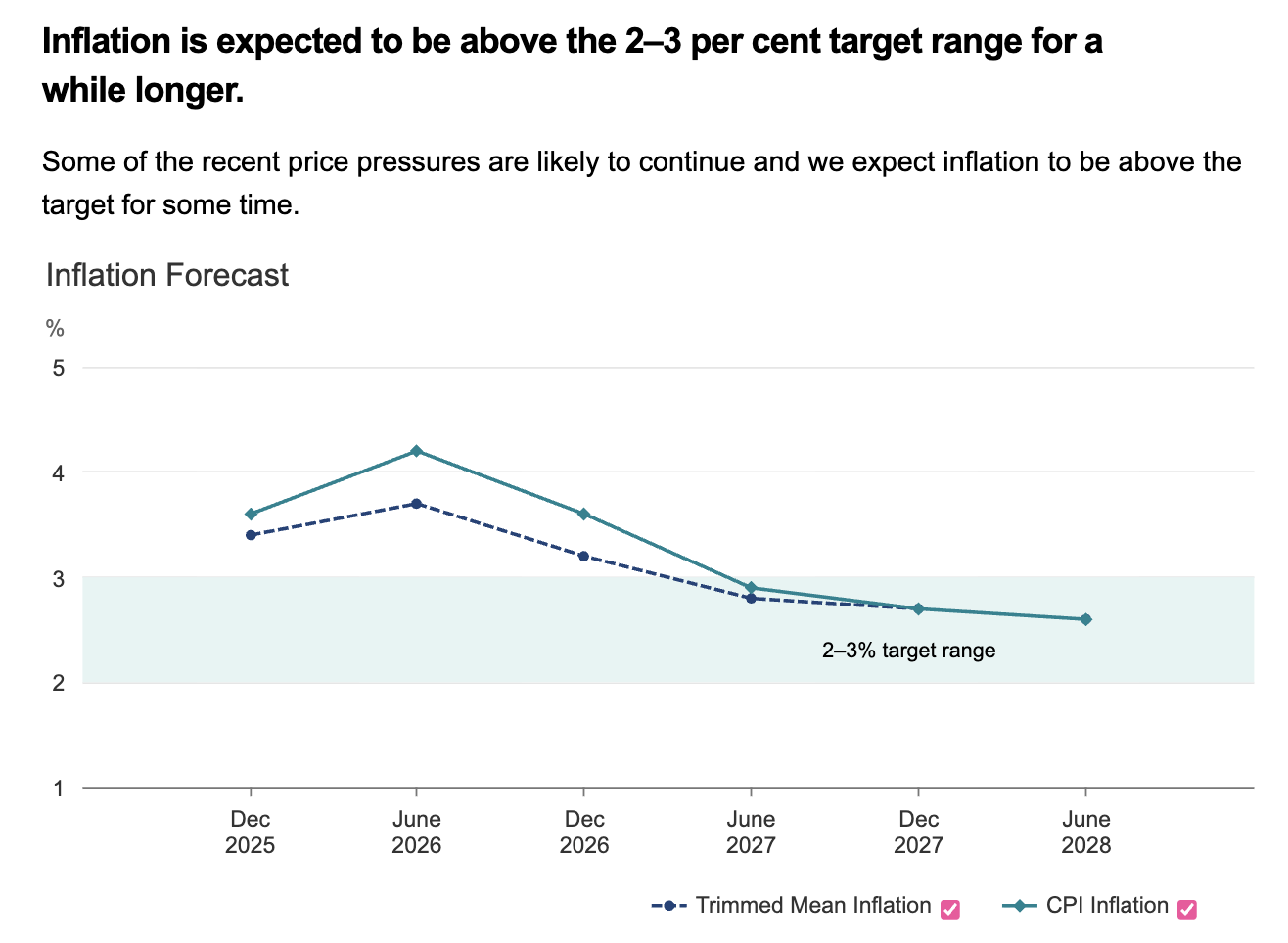

The decision, which was unanimous, comes as a direct response to a "material" pick-up in inflation during the latter half of 2025, challenging the downward trend observed since the 2022 peak.

The board highlighted that while some inflationary spikes may be temporary, the broader economic landscape reveals significant capacity pressures.

Private demand has surged beyond expectations, fueled by a robust rebound in both household spending and business investment.

The momentum is further mirrored in the housing market, where activity and prices continue to climb despite previous tightening cycles.

Labour market conditions remain a primary driver of the board’s hawkish stance. While the wage price index has eased slightly, broader measures of wage growth remain stubbornly high, and the unemployment rate continues to sit lower than forecasted.