Latest news in United States.

Grafa

Breaking News

Hilton pipeline hits half-million room record as net growth accelerates

Hilton Worldwide Holdings (NYSE:HLT) closed 2025 with an unprecedented development surge, pushing its global pipeline past the half-million room mark for the first time.

SiteOne margins expand as acquisition drive offsets seasonal net loss

SiteOne Landscape Supply (NYSE:SITE) reported a 3% increase in fourth-quarter net sales to $1.05 billion, as the company leveraged strategic acquisitions and improved pricing to navigate a seasonally slow period.

Tech

Vertiv orders explode 252% as AI infrastructure boom shatters estimates

Vertiv Holdings (NYSE:VRT) delivered a blowout fourth-quarter report, headlined by a staggering 252% surge in organic orders, signaling that the global build-out of artificial intelligence infrastructure is accelerating even faster than analysts anticipated.

Insights

What’s behind the panic-buying of gold?

In times of uncertainty, we often look for something solid to hold onto. Lately, it seems the world’s investors have decided that “something solid” is, quite literally, gold.

The metal’s soaring price is more than just a market trend; it's a global barometer of anxiety.

When faith in currencies, governments, and traditional financial systems begins to waver, we see a familiar flight to the perceived safety of this timeless asset.

Surprise! Lithium gets a recharge

Well, pull out the party hats and dust off the stock tickers.

Lithium, the commodity that investors and analysts had all but left for dead in the great market purge of 2023-2024, is back.

Billionaire bears take a swipe at Tesla

The stock market has long treated Tesla (NASDAQ:TSLA) less as a traditional automaker and more as a futuristic technology cult, with its valuation soaring on the gravitational pull of its CEO, Elon Musk.

This persistent "Musk Premium" has burned countless short-sellers.

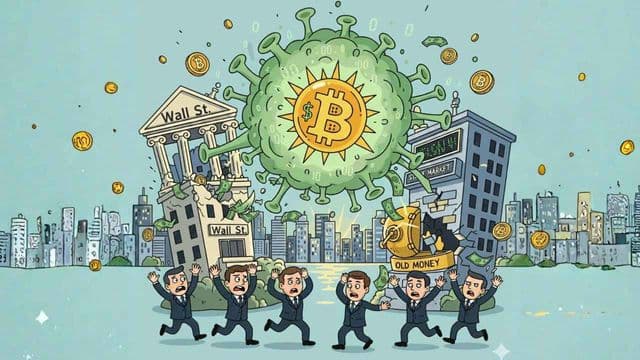

Can Bitcoin bring down the global financial system?

Bitcoin has vaporised more than US$800 billion in its latest crash and sucked US$1 trillion out of the broader crypto market.

With nearly US$2 trillion in market value and rising allocations from Wall Street firms, ETFs, pension funds, and insurers, Bitcoin is increasingly woven into traditional finance.

Economy

Loading video player...

Trump tells Davos audience US economy is booming

Trump used his Davos speech to tout US economic dominance, promote crypto, and revive his push for Greenland.

Economy

Japan’s bond selloff is gathering pace

Japan’s bond market has been sliding all week, with the 10-year yield now near 2.37% and the 40-year pushing above 4.2%, both multi-decade highs.

Trump threatens 'crushing' champagne tariffs as Macron snubs peace board

U.S. President Donald Trump has escalated his confrontation with European leaders on the eve of the World Economic Forum in Davos, threatening to impose a 200% tariff on French wine and champagne.

-640x360.jpg&w=1200&q=75)

-640x360.jpg&w=1200&q=75)