Latest news in United States.

Grafa

Breaking News

Onity Group reports record 2025 earnings, launches buyback as pivot pays off

Onity Group (NYSE:ONIT) reported the most successful year in its history, posting record net income and a significant jump in shareholder equity for 2025.

Tech

Materion Q4 2025 earnings shows record sales & defense boost

Materion (NYSE:MTRN) reported a sharp return to profitability in its fourth quarter, bolstered by record sales in its electronic materials unit and a massive new investment from the U.S. defense sector.

Iron Mountain posts record revenue, forecasts double-digit growth for 2026

Iron Mountain (NYSE:IRM) reported record quarterly and full-year results that beat expectations across key metrics, driven by aggressive expansion in its data center and digital solutions units.

Insights

What’s behind the panic-buying of gold?

In times of uncertainty, we often look for something solid to hold onto. Lately, it seems the world’s investors have decided that “something solid” is, quite literally, gold.

The metal’s soaring price is more than just a market trend; it's a global barometer of anxiety.

When faith in currencies, governments, and traditional financial systems begins to waver, we see a familiar flight to the perceived safety of this timeless asset.

Surprise! Lithium gets a recharge

Well, pull out the party hats and dust off the stock tickers.

Lithium, the commodity that investors and analysts had all but left for dead in the great market purge of 2023-2024, is back.

Billionaire bears take a swipe at Tesla

The stock market has long treated Tesla (NASDAQ:TSLA) less as a traditional automaker and more as a futuristic technology cult, with its valuation soaring on the gravitational pull of its CEO, Elon Musk.

This persistent "Musk Premium" has burned countless short-sellers.

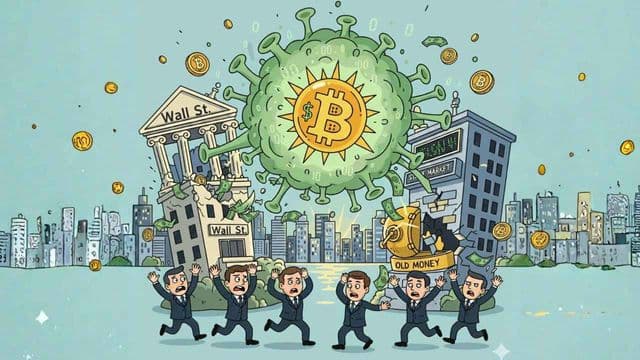

Can Bitcoin bring down the global financial system?

Bitcoin has vaporised more than US$800 billion in its latest crash and sucked US$1 trillion out of the broader crypto market.

With nearly US$2 trillion in market value and rising allocations from Wall Street firms, ETFs, pension funds, and insurers, Bitcoin is increasingly woven into traditional finance.

Economy

Loading video player...

Washington dodges shutdown, but the clock is already ticking again

Washington has pulled itself back from the brink, passing a $1.2 trillion stop-gap deal that reopened most of the US government after days of disruption.

Trump tells Davos audience US economy is booming

Trump used his Davos speech to tout US economic dominance, promote crypto, and revive his push for Greenland.

Economy

Japan’s bond selloff is gathering pace

Japan’s bond market has been sliding all week, with the 10-year yield now near 2.37% and the 40-year pushing above 4.2%, both multi-decade highs.

-640x360.jpg&w=1200&q=75)

-640x360.jpg&w=1200&q=75)