Latest news in United States.

Grafa

Breaking News

Loading video player...

Monroe Capital CEO Concerned About 'Herd Mentality' in Private Credit

Monroe Capital Chair and CEO Ted Koenig discusses the state of the private credit market and expresses his concern about private assets in 401(k) plans on "Bloomberg Open Interest."

Okapi's Goldfarb Weighs In on Warner Bros., Proxy Season

Okapi Partners CEO Bruce Goldfarb reacts to Netflix dropping out of the fight to buy Warner Bros. Discovery and Elliott Investment Management building a stake of more than 10% in Norwegian Cruise Line Holdings. Speaking on "Bloomberg Open Interest," Goldfarb also discusses the outlook for proxy season and the current regulatory environment.

OpenAI Finalizes Funding Round at $730 Billion Valuation

OpenAI raised $110 billion in funding. Investors include Amazon, SoftBank and Nvidia. It's part of the ChatGPT maker's push to secure more computing power and talent for AI development. Mandeep Singh of Bloomberg Intelligence has more.

Insights

What’s behind the panic-buying of gold?

In times of uncertainty, we often look for something solid to hold onto. Lately, it seems the world’s investors have decided that “something solid” is, quite literally, gold.

The metal’s soaring price is more than just a market trend; it's a global barometer of anxiety.

When faith in currencies, governments, and traditional financial systems begins to waver, we see a familiar flight to the perceived safety of this timeless asset.

Surprise! Lithium gets a recharge

Well, pull out the party hats and dust off the stock tickers.

Lithium, the commodity that investors and analysts had all but left for dead in the great market purge of 2023-2024, is back.

Billionaire bears take a swipe at Tesla

The stock market has long treated Tesla (NASDAQ:TSLA) less as a traditional automaker and more as a futuristic technology cult, with its valuation soaring on the gravitational pull of its CEO, Elon Musk.

This persistent "Musk Premium" has burned countless short-sellers.

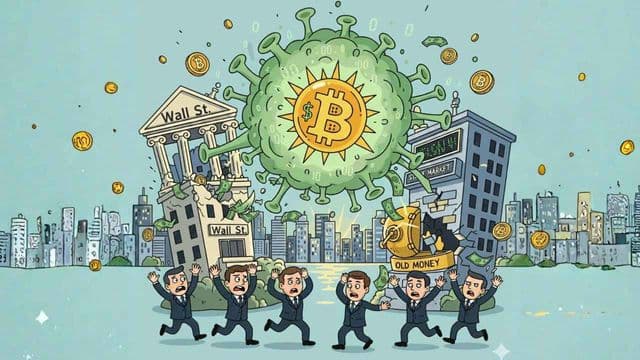

Can Bitcoin bring down the global financial system?

Bitcoin has vaporised more than US$800 billion in its latest crash and sucked US$1 trillion out of the broader crypto market.

With nearly US$2 trillion in market value and rising allocations from Wall Street firms, ETFs, pension funds, and insurers, Bitcoin is increasingly woven into traditional finance.

Economy

Economy

U.S. Customs to halt invalidated tariffs as Trump pivots to new 15% global levy

U.S. Customs and Border Protection (CBP) will officially stop collecting billions in trade duties at 12:01 a.m. EST on Tuesday, following a landmark Supreme Court ruling that declared President Donald Trump’s use of emergency powers to levy tariffs illegal.

Economy

SCOTUS dismantles Trump’s emergency tariffs in major rebuke

The U.S. Supreme Court delivered a historic blow to President Donald Trump’s economic agenda Friday, ruling 6-3 that the administration overstepped its constitutional authority by using a national emergency statute to impose sweeping global tariffs.

Economy

US jobs beat lands, but the real shock is underneath

The January US jobs report surprised to the upside, adding 130,000 roles as unemployment dipped to 4.3% and wages stayed contained.

Washington dodges shutdown, but the clock is already ticking again

Washington has pulled itself back from the brink, passing a $1.2 trillion stop-gap deal that reopened most of the US government after days of disruption.

-640x360.jpg&w=1200&q=75)

-640x360.jpg&w=1200&q=75)