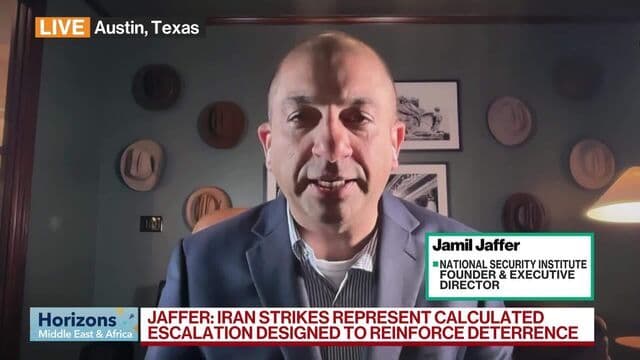

Fahmy: GCC Pulled Into Conflict They Didn't Agree to

Gulf states are being pulled deeper into the war with Iran as Saudi Arabia, Qatar and the UAE suffer attacks on non-military targets. Tehran has struck US embassies in both Riyadh and Dubai, while airports have also been damaged. Dalia Fahmy, Director of International Relations & Diplomacy; and Associate Professor of Political Science at Long Island University spoke to Bloomberg's Horizons Middle East & Africa anchor Joumanna Bercetche on the GCC's response to the Iran strikes.

-640x360.jpg&w=1200&q=75)

-640x360.jpg&w=1200&q=75)