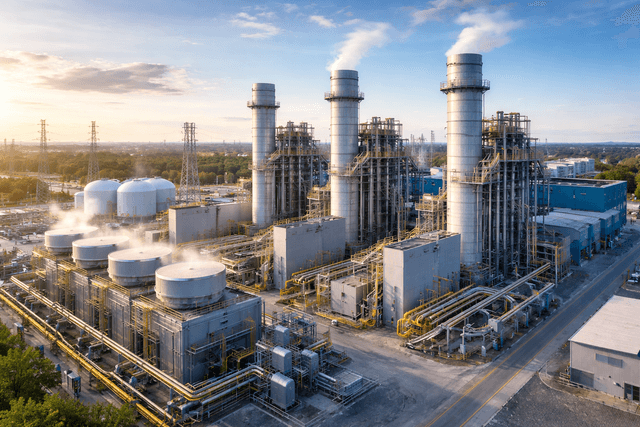

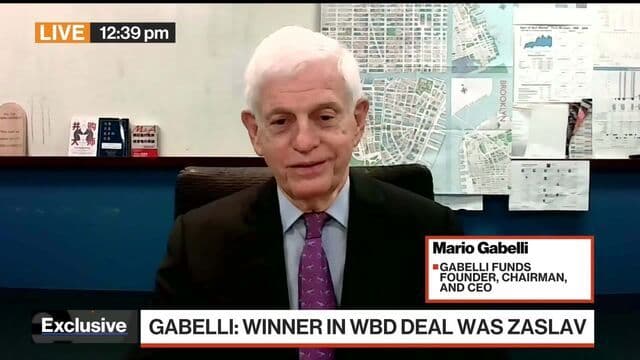

Fed's Beige Book Shows Benign Economic Outlook

In its Beige Book survey of regional business contacts, the Federal Reserve reported that in many districts "sales were dampened by economic uncertainty, increased price sensitivity and lower-income consumers pulling back on spending." Molly Smith has more on Bloomberg Television.

-640x360.jpg&w=1200&q=75)

-640x360.jpg&w=1200&q=75)