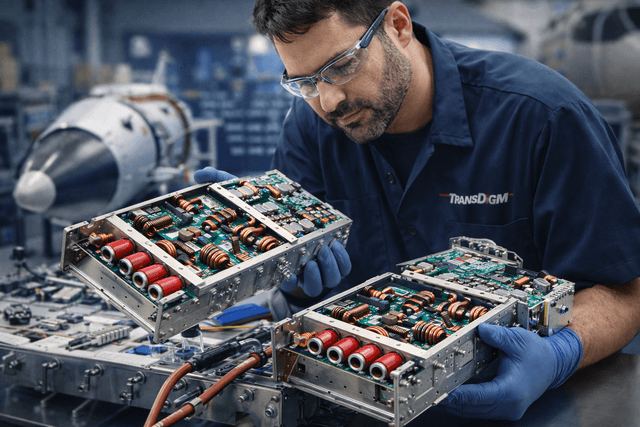

TransDigm Group (NYSE:TDG) Tuesday reported fiscal first-quarter 2026 results, delivering double-digit growth driven by a resilient commercial aerospace aftermarket and intensifying defense spending.

The Cleveland-based supplier of highly engineered aircraft components posted net sales of $2.285 billion, a 13.9% increase over the same period last year.

Adjusted earnings per share rose 5% to $8.23, surpassing the Zacks consensus estimate of $8.02.

The quarter’s performance was anchored by an "EBITDA As Defined" of $1.197 billion, representing a 52.4% margin.

While the company continues to benefit from airlines extending the lives of older aircraft due to OEM delivery delays, the true focus of the report was TransDigm’s aggressive post-quarter capital strategy.

Management disclosed that approximately $3.2 billion is earmarked for the acquisition of Stellant Systems, Jet Parts Engineering, and Victor Sierra Aviation—deals expected to further cement the company's dominance in proprietary, high-margin aftermarket parts.

Citing the strong start and the anticipated integration of recent acquisitions, the company raised its full-year 2026 guidance.