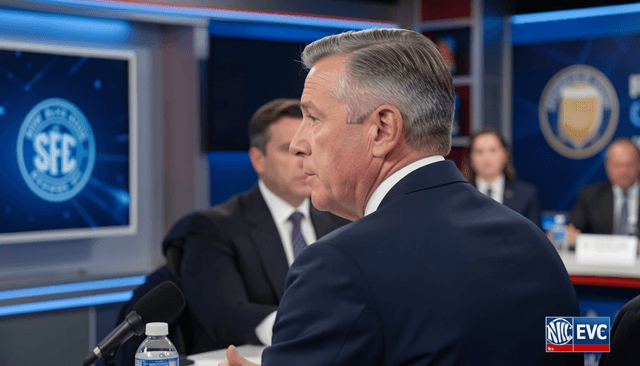

SEC chair Paul Atkins said sweeping crypto innovation exemptions are unlikely to be finalised this month, walking back an earlier timeline that had pointed to a January release.

The proposed exemptions would shield certain crypto activities, including tokenised securities and decentralised finance, from enforcement action while the sector develops within regulated boundaries.

“We’re still working on that, obviously,”

Atkins said at a joint crypto event with CFTC leadership, adding:

“We need to measure twice and cut once.”

Atkins said the uncertain progress of a US crypto market structure bill in the Senate could influence the timing, noting that:

“It would be nice to see direction from Congress”.

He added that the SEC is not necessarily waiting for legislation to pass before acting, but acknowledged there are “a lot of moving parts” affecting the decision.

The shift follows meetings earlier this week between the SEC’s crypto task force and Wall Street firms including JPMorgan, Citadel and trade group SIFMA.

Materials prepared by SIFMA warned that broad exemptions for tokenised securities could undermine investor protection and risk wider market disruption.