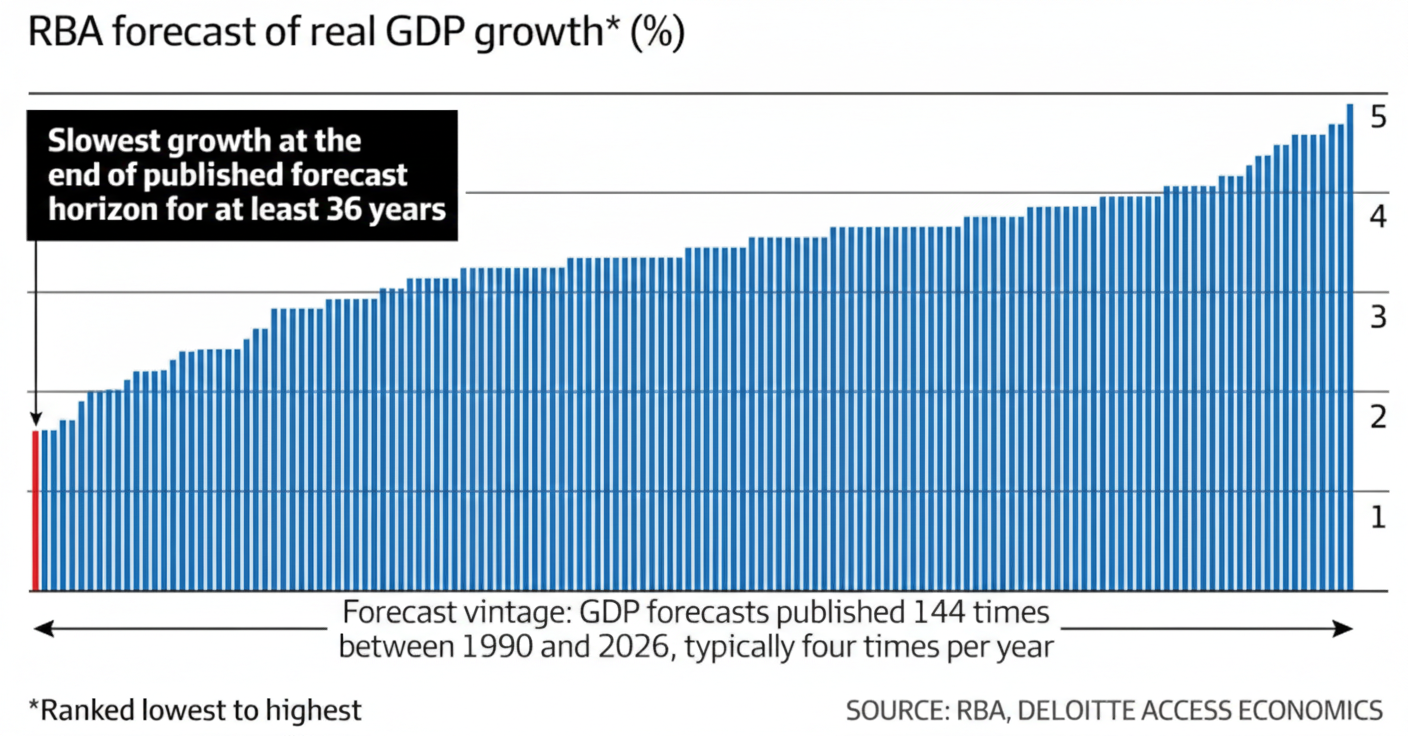

The Reserve Bank of Australia has delivered a grim ultimatum for the nation’s economic future, forecasting a record-low medium-term growth rate of just 1.6% through June 2028.

The projection marks the weakest outlook in the bank’s history—surpassing the lows of the 1990s recession and the Global Financial Crisis—prompting warnings that Australian living standards are under immediate threat.

The RBA's forecast has ignited a political firestorm over fiscal management.

While Prime Minister Anthony Albanese defended his government’s "responsible" handling of the economy, citing three interest rate cuts last year, the Parliamentary Budget Office revealed a starker reality.

PBO officials testified that a multi-billion dollar budget deterioration is driven largely by a 60% surge in government spending, contradicting Treasurer Jim Chalmers’ claims that falling tax revenues were the primary culprit.

Economists warn that the sluggish growth "pie" will struggle to support the federal budget’s sustainability.

Experts, including former Treasury official Gene Tunny, point to a "productivity desert" exacerbated by labor shifts into intensive government service sectors like the NDIS.

With the RBA's outlook sitting a full percentage point below Treasury's own projections, the government faces mounting pressure to deliver an "ambitious" productivity package in the upcoming May budget.