Nvidia (NASDAQ:NVDA) reinforced its pivotal role in the AI infrastructure landscape on Monday, announcing a $2 billion equity investment in CoreWeave (NASDAQ:CRWV).

The deal, structured as a purchase of Class A common stock at $87.20 per share, marks a deepening of the "virtuous cycle" between the world’s leading chipmaker and its most aggressive cloud-computing partner.

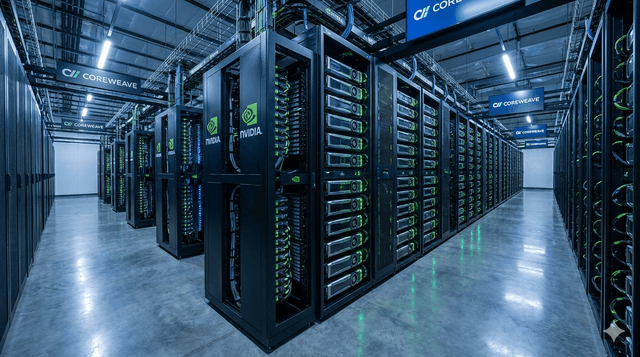

The investment is part of a broader strategic expansion aimed at accelerating CoreWeave’s ambition to build out more than 5 gigawatts of "AI factories" by 2030.

These specialized data centers are designed from the ground up to handle the massive computational loads required by frontier generative AI models.

As part of the expanded agreement, Nvidia will leverage its financial strength to help CoreWeave secure the critical components of data center scaling: land, power, and building shells.

CoreWeave, in turn, will serve as a primary launchpad for Nvidia’s next-generation hardware.

The company plans to be an early adopter of the upcoming Rubin platform, as well as Vera CPUs and Bluefield storage systems, ensuring it remains at the bleeding edge of available compute power.

The partnership also includes a software integration component.