Moog (NYSE:MOG.A) kicked off its fiscal 2026 with record-breaking results, as surging demand for defense systems and a robust commercial aerospace recovery pushed quarterly revenue above $1 billion for the first time in a fiscal first quarter.

The East Aurora, New York-based contractor also raised its full-year guidance, signaling that its record $3.3 billion backlog provides a clear runway for growth.

For the fiscal first quarter ended Jan. 3, 2026, Moog reported net income of $78.9 million, or $2.46 per share.

Excluding one-time items, adjusted earnings were $2.63 per share, handily beating the $2.24 consensus estimate from analysts surveyed by Zacks Investment Research.

Revenue for the period jumped 21% to $1.1 billion, with every business segment posting record sales.

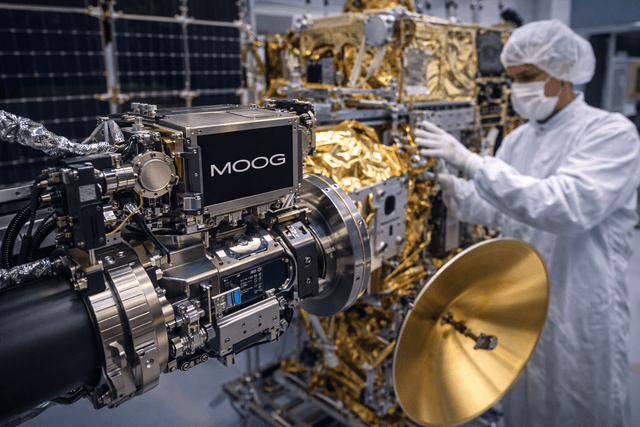

The quarter’s standout performer was the Space and Defense segment, where sales leaped 31% to $324 million, driven by intense demand for missile controls and satellite components.

Commercial Aircraft sales also saw significant momentum, rising 23% to $268 million on the back of higher widebody production rates (787 and A350) and a surge in aftermarket services.

Looking ahead, Moog raised its full-year 2026 guidance, now forecasting adjusted earnings of $10.20 per share (up from previous estimates of $10.00) and revenue of $4.3 billion.