Ericsson (NASDAQ:ERIC) reported fourth-quarter earnings that surpassed Wall Street projections on Friday, signaling that the Swedish telecommunications giant’s focus on high-margin software and operational efficiency is paying off despite a broader slowdown in network equipment demand.

The Stockholm-based company posted net income of $910.5 million for the quarter.

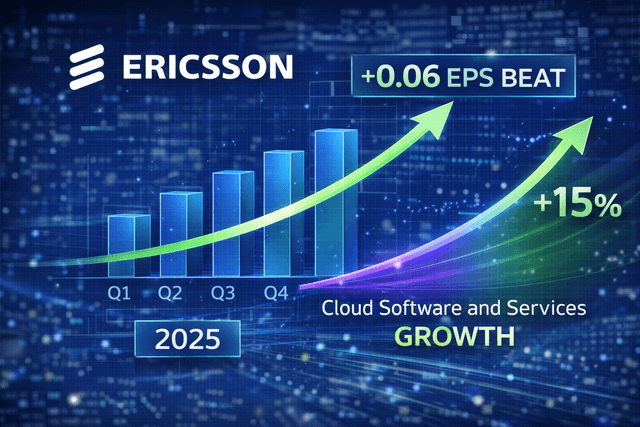

On a per-share basis, earnings reached 27 cents, beating the 23-cent consensus estimate from analysts surveyed by Zacks Investment Research.

Revenue for the period hit $7.37 billion, reflecting a challenging but stabilizing environment for mobile providers.

For the full year 2025, Ericsson reported a profit of $2.91 billion, or 87 cents per share, on total revenue of $24.19 billion.

The results were bolstered by a significant margin expansion in its Cloud Software and Services segment, which saw organic growth as carriers increasingly prioritize network programmability and automation over new hardware rollouts.

Reflecting its strengthened cash position—which surged to 61.2 billion kronor ($5.8 billion) at year-end—Ericsson’s board proposed a dividend increase to 3 kronor per share and announced a new 15 billion kronor ($1.4 billion) share buyback program.