Brazilian lawmakers advanced a bill that would outlaw algorithmic stablecoins such as USDe and Frax, tightening rules in a market where stablecoins account for about 90% of crypto transaction flows.

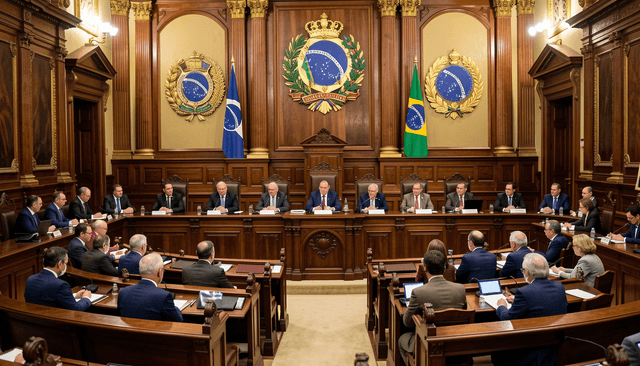

Bill 4.308/2024, approved by Congress’s Science, Technology and Innovation Committee, would prohibit the issuance or trading of stablecoins that rely on code rather than full collateral backing.

The proposal would require all domestically issued stablecoins to be fully backed by segregated reserve assets and introduce prison sentences of up to eight years for minting unbacked tokens, classifying such activity as financial fraud.

Foreign issuers such as Tether and Circle would need authorisation to operate in Brazil, while local exchanges would be responsible for verifying equivalent compliance or assuming direct risk.

Lawmakers cited global concerns following the 2022 Terra collapse and the rapid growth of dollar-linked tokens in Brazil, where stablecoins dominate reported crypto volumes, according to tax authority data.

The bill still requires approval from additional committees and the Senate, but would force algorithmic stablecoin projects to redesign their models or exit a market processing an estimated $6 billion to $8 billion in monthly crypto volume.

The move signals Brazil’s push toward a fully collateralised and closely supervised stablecoin framework as regulators seek greater control over cross-border flows and systemic risk.