The Australian housing market has entered a period of cooling as the "big two" cities, Sydney and Melbourne, hit a near-standstill, according to data from Cotality.

Despite a national value increase of 0.8% in January, the rolling quarterly growth rate slowed to 2.4%, signaling a shift in momentum.

Property values in Sydney edged up by a marginal 0.2%, while Melbourne saw a mere 0.1% gain over the last three months, highlighting their sensitivity to shifting economic headwinds.

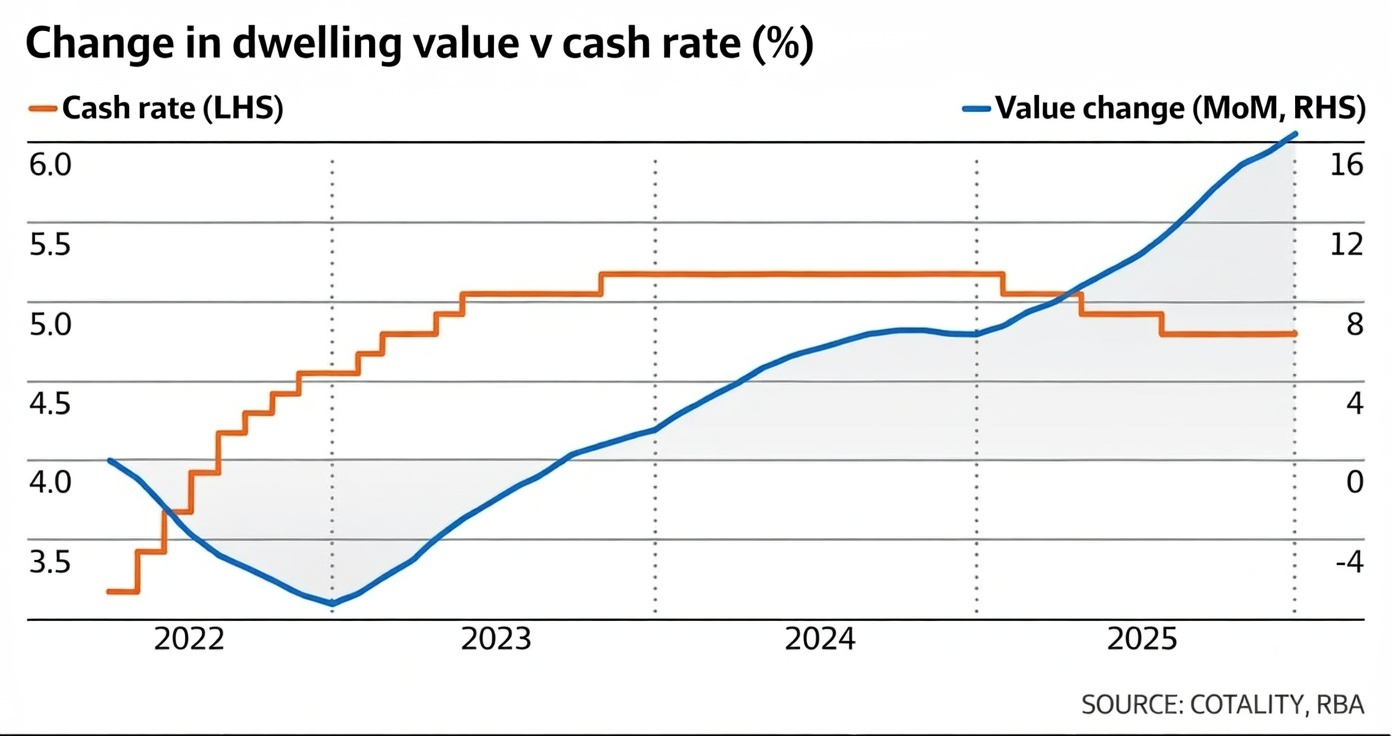

The deceleration comes as all "Big Four" banks anticipate a Reserve Bank U-turn.

Following "hot" inflation data—which hit 3.4% in the December 2025 quarter, exceeding the RBA’s 3.2% target ceiling—expectations are mounting for an interest rate hike as early as this week.

Cotality Research Director Tim Lawless noted that these expectations often disrupt consumer confidence well before any official policy change, leading buyers to defer "high-commitment" financial decisions.

While the prestige market begins to dip, the lower-to-middle tiers remain competitive due to a chronic undersupply.

Nationally, advertised listings are 25% below the five-year average, a scarcity exacerbated by state infrastructure projects drawing labor and resources away from residential construction.

Mid-sized cities continue to defy the trend; Perth and Brisbane recorded monthly gains of 2% and 1.6% respectively, bolstered by robust interstate migration and stronger underlying fundamentals.