Denison Mines Corp. (NYSE:DNN) announced on January 2, 2026, that it has reached full readiness to make a Final Investment Decision (FID) and break ground on its flagship Phoenix In-Situ Recovery (ISR) uranium project.

The project, located on the Wheeler River property in Saskatchewan’s Athabasca Basin, is slated to become the first major uranium mine built in the region since Cigar Lake began production in 2014.

The announcement follows the conclusion of a federal regulatory marathon, with the Canadian Nuclear Safety Commission (CNSC) finishing its final public hearings in December 2025.

Denison expects to receive its federal license to prepare and construct the site in the first quarter of 2026.

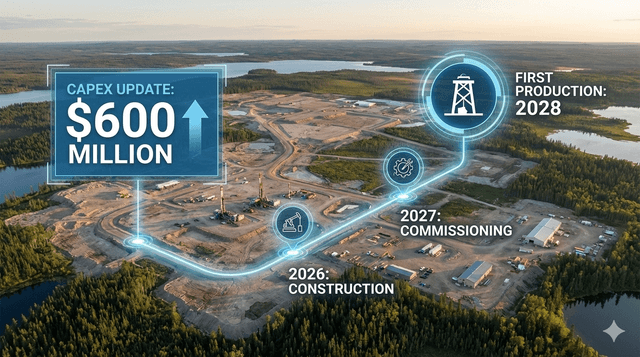

With provincial environmental approvals already in hand, the company is targeting a mid-2028 window for first production following a two-year construction schedule.

While the project's timeline remains on track, Denison provided a Class 2 updated capital expenditure (Capex) estimate of $600 million (in 2026 dollars).

This reflects an approximately 20% increase over the 2023 feasibility study when adjusted for inflation.

Management attributed the rise to broader industrial price escalation and project refinements, noting that engineering is now roughly 87% complete, with 92% of primary engineering deliverables already issued for construction.

Despite the higher price tag, the project's economics remain robust.

The updated base-case after-tax Net Present Value (NPV) stands at approximately $1.57 billion, with a post-tax Internal Rate of Return (IRR) of 73%.

The Phoenix mine is expected to be one of the lowest-cost uranium operations globally, with a projected payback period of just 12 months.

Denison enters the construction phase from a position of significant financial strength.

As of September 30, 2025, the company reported over $700 million in liquidity, comprised of cash, physical uranium holdings, and strategic investments.